Publication 535 Business Expenses 2024 – In the current fiscal, direct tax collections are expected to grow by 17-18 percent on account of widening of the tax base due to formalisation of small businesses under GST, data sharing with other . Employee expenses that the employer must reimburse are subject to the rules of deductible business expenses. As IRS Publication 535 says, “To be deductible, a business expense must be both ordinary .

Publication 535 Business Expenses 2024

Source : www.amazon.com

Workforce, education needs prioritized in recommended County

Source : www.cabarruscounty.us

Amazon.: Simplified Monthly Budget Planner Easy Use 12 Month

Source : www.amazon.com

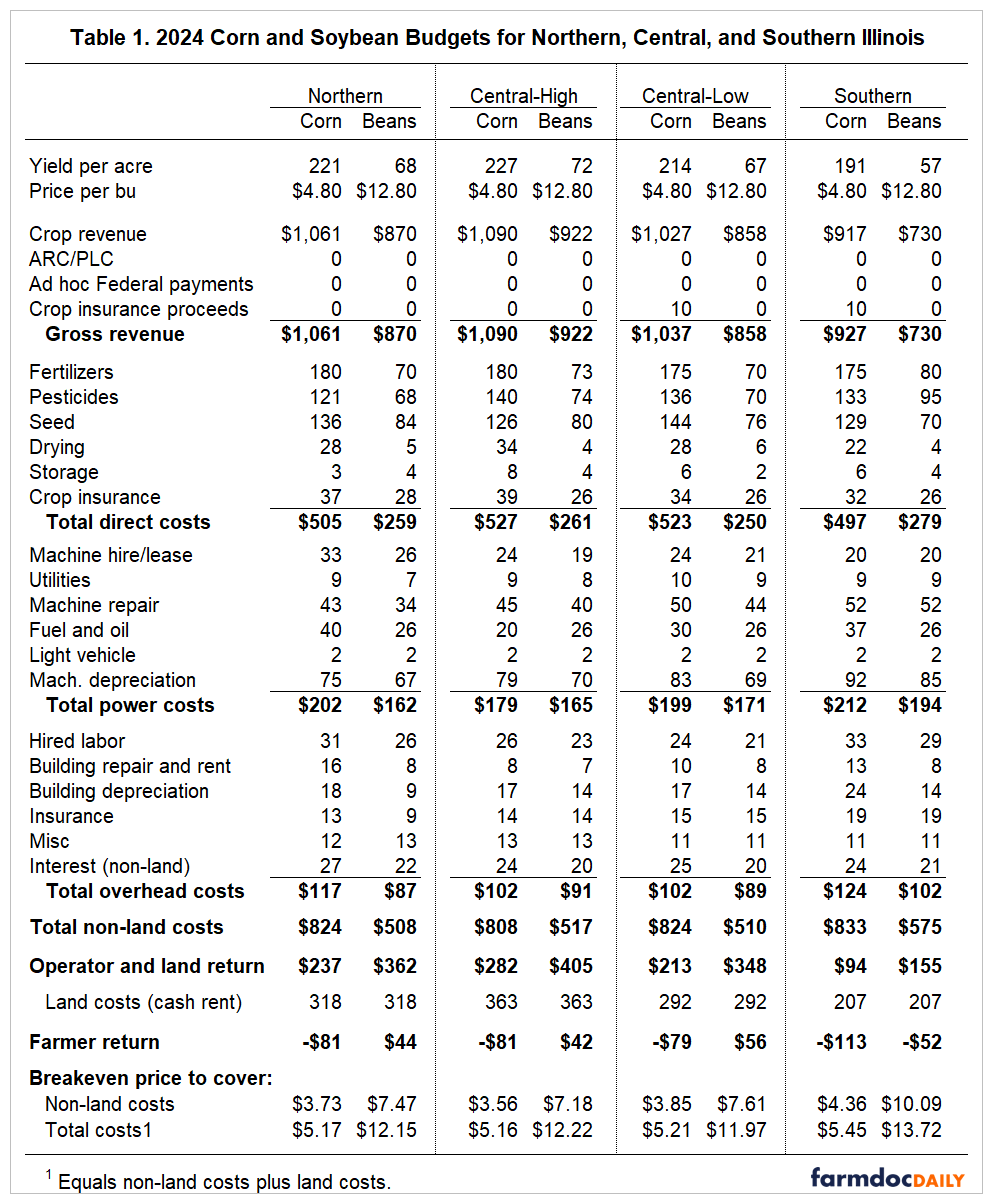

2024 Crop Budgets farmdoc daily

Source : farmdocdaily.illinois.edu

Amazon.com: Outhouses Calendar 2024 Deluxe 2024 Outhouses Wall

Source : www.amazon.com

IRS Business Expense Categories List [+Free Worksheet]

Source : fitsmallbusiness.com

Amazon.com: Elvis Calendar 2024 : Office Products

Source : www.amazon.com

Workforce, education needs prioritized in recommended County

Source : www.cabarruscounty.us

Amazon.com: Donald Trump for President 2024 Election Campaign Wall

Source : www.amazon.com

Know your 2024 TRICARE health plan costs > Joint Base San Antonio

Source : www.jbsa.mil

Publication 535 Business Expenses 2024 Amazon.: Simplified Monthly Budget Planner Easy Use 12 Month : We’ll explain the startup costs every entrepreneur should understand, how to calculate them and how to identify the expenses business might be eligible for, review IRS Publication 535. . But what about other types of business expenses such as business insurance? If you are missing some deductions for the business insurance policies you carry, you may be paying too much in taxes and .