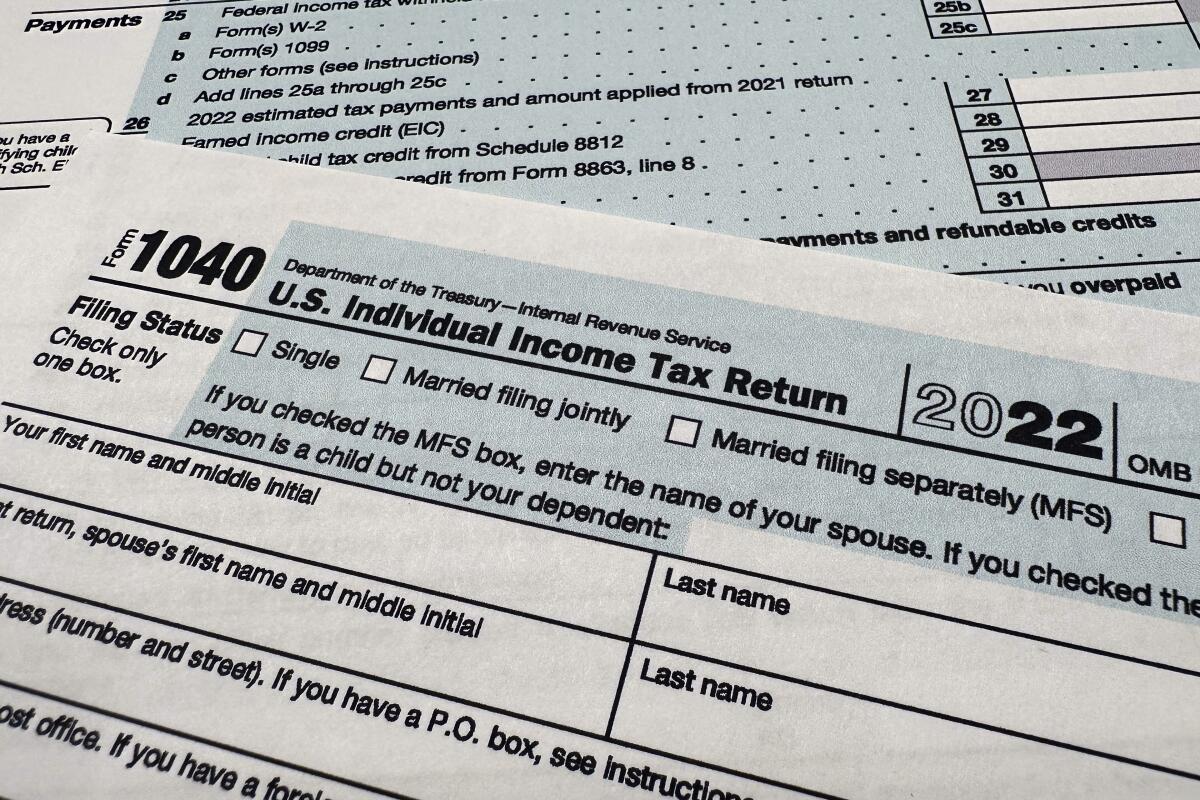

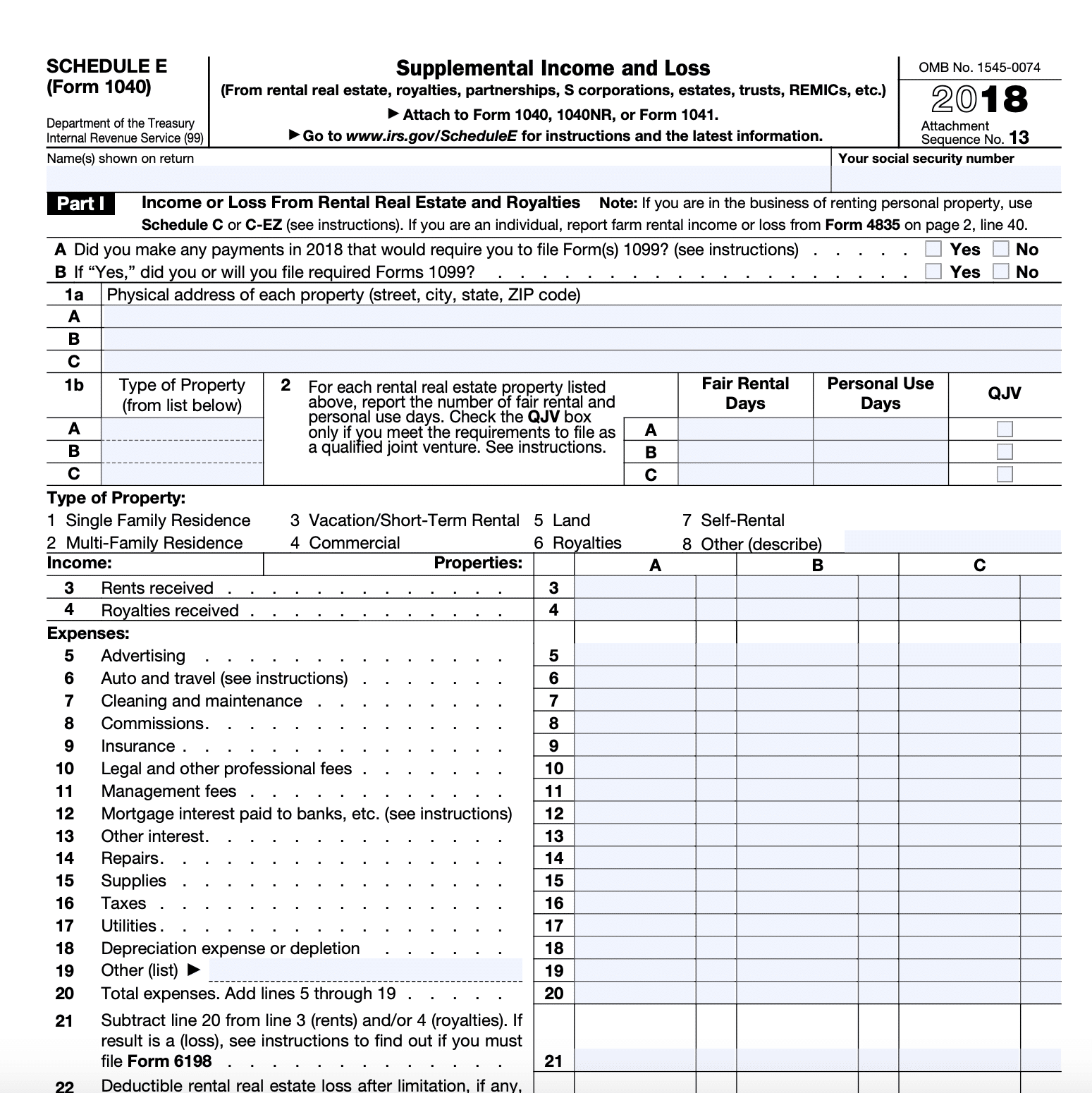

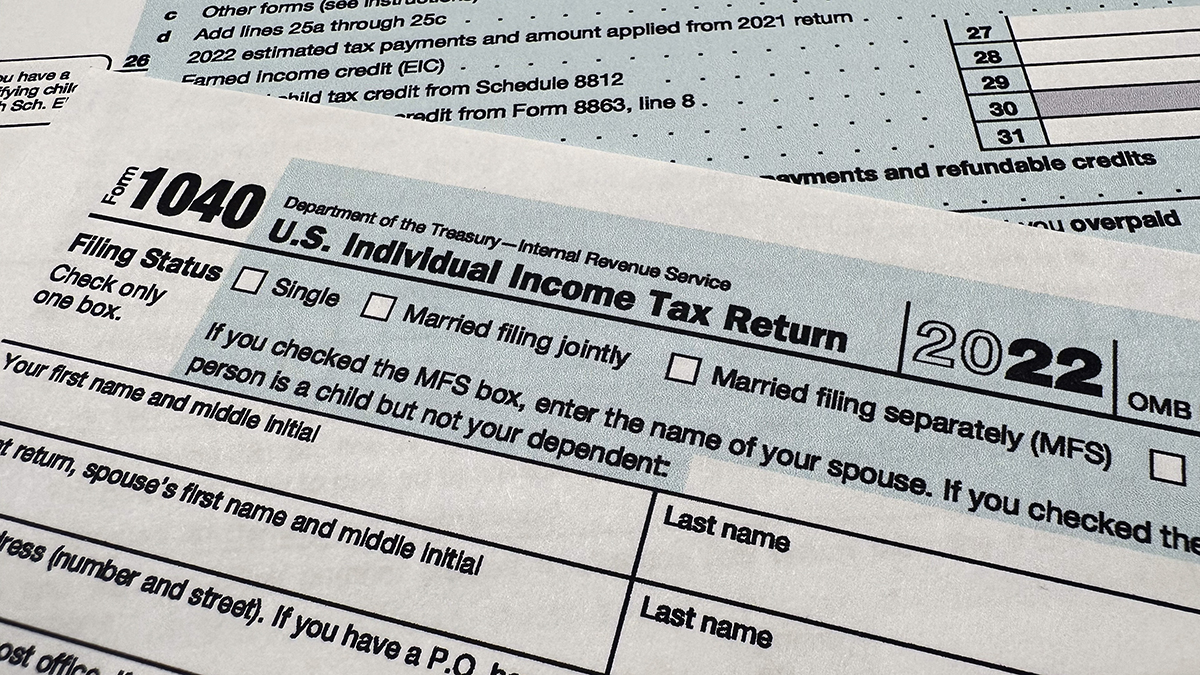

Irs Form 1040 Schedule E 2024 – Schedule E is a supplemental tax form that is submitted along with your primary tax return (Form 1040) by the mid-April tax filing deadline or by mid-October with an extension. Partners and . Choose whether you are going to take the standard deduction or itemize your deductions on Schedule A Your Completed Form Finally, send your completed Form 1040 to the appropriate IRS address .

Irs Form 1040 Schedule E 2024

Source : www.sandiegouniontribune.com

Tax Return Forms, Schedules: e File in 2024 for 2023 Returns

Source : www.efile.com

What Is Schedule E? Here’s an Overview and Summary!

Source : thecollegeinvestor.com

Tax Year 2023: January December 2023. File Your Taxes

Source : www.efile.com

IRS to Launch Free E Filing Program in 2024. Here’s What to Know

Source : www.nbcboston.com

What Is a Schedule E IRS Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

IRS moves forward with free e filing system in pilot program to

Source : www.columbian.com

IRS moves forward with free e filing system in pilot program to

Source : ny1.com

Schedule E Instructions 2023: How to Fill Out Schedule E Form

Source : www.noradarealestate.com

LifeCycle Tax and Wealth Management | Pensacola FL

Source : www.facebook.com

Irs Form 1040 Schedule E 2024 IRS moves forward with free e filing system in pilot program to : In the meantime, to give taxpayers more time to get accustomed to the change, the IRS is planning for a threshold of $5,000 for tax year 2024 as part of a phase and an offsetting adjustment on a . Once again, the IRS has delayed implementation of new rules that would have resulted in a Form 1099-K being sent to more than 30 million Americans who received payments this year through PayPal, Venmo .